澳洲幸运5开奖官网开奖 Game Development

Services

Hire Game Developers

Our skilled developers excel in taking your game from concept to launch, ensuring it embodies the highest quality standards. At Game-Ace, we focus on crafting engaging gameplay and ironing out any issues, making your game ready for a stellar release. Partner with us for development needs, and our committed developers will ensure your game stands out in the market, polished and perfected for gamers.

Our Talent Pool

Our Art Department comprises over

120+ specialists across various categoriesOur Dev Department includes over

280+ specialists across various categoriesWhy 澳洲5幸运彩 Game-Ace

With extensive game development experience, we guide your project from concept to release.

We're flexible in team scaling to meet your needs, cutting costs and delivering projects within tight deadlines.

Our talent pool of 400+ specialists excels in diverse gaming projects, from large-scale mobile games to console releases.

Our certified developers create high-quality games across various genres and platforms.

Core Engines We Use

Game-Ace has been taking advantage of the Unity game engine for over a decade, continually proving its beneficial impact on game creation. With the help of this powerful cross-platform engine, our game development company has crafted dozens of projects in many genres and styles, as well as targeted at different platforms. Knowing all the ins and outs of Unity 3D engine, experts on our team always show top-notch game development results.

Unreal Engine remains an industry-leading game development platform, offering an incredibly versatile tech stack right out of the box. Fortunately, throughout years of professional operation and hands-on practice, our game development studio has mastered everything this engine has in store. That is why Game-Ace can now guarantee top-tier quality in game development for every client willing to reveal the full potential of Unreal Engine for their project.

About

澳洲幸运5结果官网 Game-Ace

Game-Ace is a custom game development studio, operating as a division of Program-Ace, a globally recognized software development company. Since 2005, our team has successfully delivered numerous 2D and 3D game projects.

Our commitment to innovation, exceptional quality, and utmost customer satisfaction has firmly established Game-Ace as a trusted and reliable partner in the industry.

Learn More

That bring success to our clients and joy to their audiences, regardless of devices they play on.

Fully dedicated to their craft of game development, with the expertise needed to get the job done.

In a variety of genres, from small or mid-size mobile products to top-notch PC or console titles.

Of expert team members who know the score whatever the project they focus their efforts on.

That bring success to our clients and joy to their audiences, regardless of devices they play on.

Fully dedicated to their craft of game development, with the expertise needed to get the job done.

In a variety of genres, from small or mid-size mobile products to top-notch PC or console titles.

Of expert team members who know the score whatever the project they focus their efforts on.

Games We Worked On 平台168官方网站

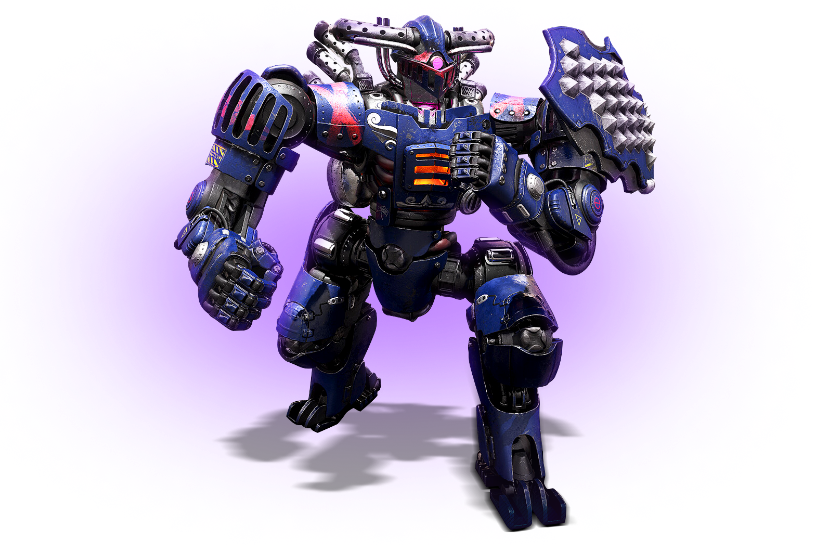

The Protagonist: EX-1

Learn More

The Protagonist: EX-1

Learn More

Farmerama

Learn More

Farmerama

Learn More

Diamond Drone

Learn More

Diamond Drone

Learn More

VR Terragame

Learn More

VR Terragame

Learn More

Evil West

Learn More

Evil West

Learn More

Haiku

Learn More

Haiku

Learn More

Skyscraper

Learn More

Skyscraper

Learn More

Nomadland NFT Game

Learn More

Nomadland NFT Game

Learn More

Star Archer VR

Learn More

Star Archer VR

Learn More

Knight - Stack Jump

Learn More

Knight - Stack Jump

Learn More

Hopster's Alphabet Hotel

Learn More

Hopster's Alphabet Hotel

Learn More

They Trust Us

Faq

Game-Ace follows world-class practices in order to deliver premium-quality games that do the work they should — attract new players and keep all the existing ones interested. First and foremost, we start communicating with each new client, discuss all the project details, set the time frame for adequate work completion, as well as plan our workflows beforehand.

Our game development company heavily bets on quality, performance, transparency, and continuous communication with every client. Since Game-Ace has operated in the global market already for 17 years, our team knows all the ins and outs of the game development process, being aware of how to approach each issue that may pop up during project execution.

So, what does our unique game development approach encompass?

-

Cross-platform development. Game-Ace specializes in developing video games for a broad spectrum of gaming platforms. The proficiency of our team in working with game engines, such as Unity or Unreal, enables us to build a product and optimize it for mobile, PC, console, or other platforms of your preference. Whether you need an iOS mobile game or a large-scale title for consoles, the expertise of specialists at Game-Ace is more than enough to make it happen.

-

Custom-tailored results. Professionals at Game-Ace fine-tune their workflows and development habits to satisfy our clients’ expectations, inasmuch as each project is unique, so it requires a personal touch, which our team is incredibly good at after so many years of delivering games of different complexity. We start off by discussing your future project’s requirements and other details that may shed light on our role in its execution. Such a personalized approach helps us quickly identify your needs and offer custom solutions.

-

Bet on functionality & quality. We hire and train developers, 2D/3D artists, as well as other specialists involved in the game development process with maximum attention paid to their experience, portfolios, hard/soft skills, etc. That is why you can be confident that your game will be delivered on time, have all the agreed functionality, and impress your target audience with graphics quality. After a thorough QA phase, your product will undoubtedly have no critical bugs or any other issues that may prevent players from enjoying the gameplay. The Game-Ace team is proud of its approach to game development because it ensures holistic project execution, creating a feeling of an integral product.

-

Player-friendly interfaces. Our UI/UX designers and artists are qualified to produce premium-quality content for any of your games, whether it’s a casual mobile project or an epic action RPG optimized for consoles of the latest generation. Equipped with extensive theoretical and practical knowledge of how players interact with menus, our designers will craft a unique interface built specifically for your game.

-

One-stop shop. Our game development studio offers the full range of services you might ever need in the industry. We can produce and animate art assets, write scripts, build architecture, integrate everything into a game engine you choose, etc. Since Game-Ace is a full-cycle game development agency, our team members are ready to supply you with anything you may want your game to feature, irrespective of the genre. We are experienced in delivering metaverse, Web3, NFT, XR, mobile, and traditional games. Thanks to 17 years of professional operation in the international market, our team defies any challenges because we prioritize client satisfaction more than other aspects of cooperation.

Ultimately, our approach to game development rests on the pillars of quality, functionality, attention to detail, punctuality, and adherence to standards that lie at the core of Game-Ace. If you choose to cooperate with us, you won't need to worry about the technical side of your project.

Our game development company follows the 5-stage pipeline that encompasses such phases as pre-production, production, and post-production. However, we also include quality assurance and launch as the essential stages before post-production. Let’s dive deeper into our workflow for you to understand the secret of our successful project completion strategy.

1. Pre-production

In this stage, we communicate with the client, brainstorm ideas, elaborate on the development plan, conduct the discovery phase, and create concept art to serve as a reference for artists. If we sum up all the activities we do during pre-production, the list will look as follows:

- market and competitor review;

- identifying a gaming platform;

- choosing the right target audience and monetization type;

- plan resources;

- looking for and producing references;

- analyzing risks;

- working on a coherent marketing strategy.

Since we abide by the world-class principles of game development, we always have a previously concocted game design document (GDD) at our fingertips. There we specify the project requirements, game genre, concept, plot, level design, UI elements, gameplay mechanics, and other essential aspects of your game.

2. Production

This stage is the most extensive and challenging because it marks the start of the work in full swing, including the creation of visual content, coding, level, and audio design, voice acting, plot, as well as the rest, all of which needs to end with a playable prototype. Throughout the production phase, our artists work on high-quality game assets and animate them, while developers integrate everything into a game engine to build levels as well as write scripts to create gameplay mechanics. When the first draft is complete, we show it to our client. Upon approval, we continue the production stage until it’s entirely playable. Then it’s time for quality assurance.

3. QA phase

Quality control and assurance are vital parts of any game development project. Without this phase, you can never be confident that your product performs as expected. That is why our in-house QA specialists conduct the following number of tests to make sure that the game they work on will be of the highest quality possible:

-

Functional testing. As the name suggests, we refer to this range of test types in order to check the functional aspects, which include:

a. Interoperability testing (to examine the system’s interaction with other internal and external components).

b. Smoke testing (to check whether the deployed build functions as expected).

c. Regression testing (to ensure that new modifications haven’t affected the already implemented system’s functionality).

d. Security access control testing (to identify whether a game is secure).

e. User acceptance testing (to make sure that a game meets a potential player’s expectations and needs). -

Non-functional testing:

a. Performance testing (obviously, to check your game’s performance on different devices).

b. Stress testing (to be sure that the game won’t break even under the harshest conditions).

c. Usability testing (to learn how user-friendly your game is).

d. Compliance testing (to ensure that every single aspect of your product is compliant with the norms and rules that a target gaming platform abides by).

e. Load testing (to examine the performance of your game in simulated real-life conditions).

Only when your product passes all these and many more types of testing (including alpha and beta) can it move on to the next stage of its life cycle.

4. Launch

As the final game development phase, it marks the point of no return when your product is entirely ready to be released on the discussed platforms. Moreover, in this phase, our game development studio can help you launch the game on your own under our aegis, which can be a persuasive argument for those lacking experience yet having a huge desire to release a game.

5. Post-release

Having collected all reviews and feedback from players, Game-Ace can process them as well as fix all the issues in the form of an update. When the game is released, there’s still a lot of work to do. So our game development team can continue delivering value for your game even after its launch. Even after the release, we stay in touch with our clients, always trying to improve the game based on the feedback collected from players. The mission of our game development company is to ensure that each client is absolutely satisfied with the result.

If you’ve realized that you want to develop a game, there are multiple ways to make it right in your specific case. Although a more precise conclusion can be made based on the first call and the discussion of your project, some essential things can be pointed out right away. Fundamentally, there are a few approaches you can follow in order to launch your own game development project.

The first way to make it happen involves these steps:

- come up with a game concept and look for references;

- research the market and review competitors;

- build a team of capable developers;

- arrange a workspace with all the necessary hardware and software;

- test your game build;

- release the product using your own forces.

Another approach is more hybrid and less independent. It requires you to extend your in-house team with the help of team extension (outstaffing) services. In other words, you follow the first 4 steps described above until you build your in-house team and an office, but you augment it with experienced employees from another company. This method allows you to manage the game development process on your own but share the responsibility with a reliable partner. That’s why we can both offer you our dedicated team or hire the required developers for your project.

Finally, the most cost-effective way to develop an enthralling and functional game is to outsource the entire product life cycle to professionals who know their job. Fortunately, Game-Ace, our game development company, can lend you a helping hand with this initiative. A desire to create a powerful product for your target audience is an excellent starting point! So, what are the genuine benefits of outsourcing game development?

-

Cost-effectiveness. As mentioned above, you save time and costs whenever you resolve to utilize the potential of a professional, experience, as well as reliable partner. Why is it so? Primarily, game development outsourcing costs less than keeping an in-house team because you don’t need to pay a monthly wage since they are not your employees in the original meaning. Instead, you only pay based on the cooperation model you choose. As a rule, they include Time & Material, Fixed Price, and a Dedicated Team. Therefore, you discuss all the terms and deadlines with the game development outsourcing company you choose, so this approach is more flexible as well as friendly. In addition, you don’t need to pay for hardware, software, and office, inasmuch as a studio already has it all.

-

High-quality results. Since the studio you entrust your game project with is an experienced professional that has finalized dozens, if not hundreds, of similar products for other clients, you get a well-polished app at the end of your journey. After all, such game development studios have everything at hand in order to ensure top-tier graphics quality and optimization for your game, no matter what platforms you aim at.

-

Flexibility and optimal resource management. When you outsource the development of your game project, you save not only costs but also time, which implies that you have more control and focus over your internal resources, let alone the freedom to manage business-related aspects of your project. For instance, you can have more time to spend on marketing, revisiting your business strategy, or forecasting future expenses. There’s a wide range of aspects to take care of while your outsourcing team is busy with the technical stuff.

-

Post-production support. Your game’s release doesn’t mark the end of the project because it can continue long after it appears on the marketplace of a specific platform. Even after the release, Game-Ace can harvest your players’ feedback and review the work being done to resolve critical issues, improve performance, etc.

-

Sharing responsibility. It’s no secret that doing everything on your own is complicated not only from the technical perspective but also given all the psychological pressure that accompanies your workflows. When you rely on the shoulders of experts, it’s far easier and less stressful to guide your project to release without any significant challenges. Still, the authorship and intellectual rights, as well as the source code, fully belong to the client.

That’s why we highly suggest taking advantage of our game development services because they will allow you to finish your game on time, make it polished, and retain more control over the internal resources. With Game-Ace, you can do a lot more within a limited time frame and not sacrifice the quality or performance of the final product.

The cost of a game development project varies based on multiple factors, such as its scale, scope, team composition and size, deadline, gameplay type, genre, etc. In order to estimate the budget for your future game, the best solution is to contact our specialists and discuss the project with them. As a result, you’ll acquire a crystal-clear vision of what and how to do.

Without further ado, let’s cross the i’s and dot the t’s on the example of mobile game development.

-

Test prototypes. Demos and the like usually don’t require much time as well as budget to complete because these are far from complete products. Therefore, the price for their development starts from $10k.

-

Casual games. Depending on the project scope and scale, as well as the type of gameplay, these apps usually cost $20k — $150k to develop.

-

Midcore games. If you want this kind of mobile game, be ready to spend about $150k — $500k. Everything will depend on other factors because the scale of such entertainment apps is already larger than in casual ones. Such products require more time and effort to make.

-

Hardcore games. This term has nothing to do with the complexity level of your game. In this meaning, it describes the scope of work to do in order to develop it. Also referred to as AA games, they require $500k — $1m to develop, which is a huge deal in the mobile game development industry. Everything more complex and budget consuming belongs to the category of AAA games.

When it comes to games meant for other platforms, the price range may be even higher, depending on the type or genre. The same goes for gaming platforms. Everything should be taken into account because the pipeline is ramified, there can be various team compositions depending on your game’s scale, and you should mind many variables affecting the result. Hence, it’s highly recommended that you get in touch with us beforehand, and together we’ll calculate the costs.

In any event, the total price can be discussed only throughout an interview, during which we analyze your game idea, plan all the processes along with resources, and build the game design document. In cases other than that, it’s almost impossible to provide a clear financial vision. Furthermore, you cannot plan anything with your game project until you calculate the costs because a carefully thought-out description of your further steps is already half of the work.

This question is as complex and multi-dimensional as everything touching upon the production stage as well as its costs. In other words, it's incredibly difficult to estimate the number of hours needed to develop a game since you should consider a broad spectrum of variables, such as genre, style, type, scale, scope, budget, team composition, its seniority level, etc. You cannot tell right away what deadline to make for your development team. This requires research.

Let's dive into each variable affecting the time frame for your game project.

-

Scale. The mathematics here is pretty straightforward — the simpler the game, the less time your game development team will require to implement all the features and release the product. In contrast, the more complex and feature-rich the project, the more hours you'll have to spend in order to get everything done perfectly. Such aspects as your game's depth, number of levels, pixels of an open world, or polygons in your models (for 3D) will significantly affect the deadline you'll want to establish for the team.

-

Resources. This variable isn't only about money. Resources consist of people, hardware, software, and everything you can utilize in order to make your game. Without a doubt, if you have a capable team, you can designate every game development aspect to a specific team member, which will considerably simplify the production stage. In this case, the math is simple as well — the more resources, the quicker and more quality the result.

-

Tech stack. As one of the most time- and resource-dependent parts of game development, the set of technologies you employ is going to either shorten or extend the time needed to build your game. For instance, if you need to create a casual 2D mobile game, you may want to consider using Unity, HTML5, Spine, Photoshop, or other tools that will optimize your workflow and time. That's where your outsourcing partner steps in. Working with specialists like Game-Ace allows you to forget about the technical part because our team will cherry-pick the best tech stack for your project based on its characteristics.

-

Genre & style. This point is as obvious as it seems. Imagine a 2D casual mobile game for Android and a gaming metaverse — how much time will you need to develop each project? In the first case, you may need a couple of months, whereas, for the latter, it's difficult to establish a clear deadline because you'll have to take into account multiple features. Metaverse game development may take a year or far more, depending on how much you want it to happen and the number of resources at your disposal.

-

Team composition & seniority level. Although this point has already been touched upon when we talk about the resources, the team composition and its expertise are crucial factors that hugely affect the game development time frame. If you, say, have a team of 2 programmers, 1 game designer, 2 artists, and 1 project manager, you are more likely to finish your game project within months than if you, for example, lack the number of particular specialists or even don't have some of them.

Most often, development time isn't constant. Conversely, if your team lacks experience, you should be ready to move the deadline further until your project is polished. Nevertheless, given that you cooperate with a game development outsourcing studio like Game-Ace, you won't need to worry about multiple distracting things, inasmuch as we take care of all of them.

Based on the 18-year experience of Game-Ace, our team relies on the two most functional game engines in the industry — Unity and Unreal, preferring one over another depending on our needs. Additionally, sometimes we refer to other game development platforms, such as Cocos2d, PlayCanvas, HTML5, and BabylonJS.

In each specific case, we may want to take advantage of Unity or Unreal Engine based on a high number of criteria as well as discussing the whole tech stack with our clients. Sometimes you may wish to use only a specific game engine for a plurality of reasons.

Consequently, in what cases should you resolve to develop your game using Unity?

-

You desire to make a mobile or mid-core game without millions of features. Rumor has it that game developers use Unity only when they need to quickly build a simple and low-quality game. However, this statement is a misconception that’s far from reality. As a matter of fact, Unity has become an incredibly powerful game engine with a lot of features to tweak, excellent graphic support, and many other benefits to make use of. Despite this, we suggest developing a mobile or mid-core game using Unity because it’s more straightforward, cost-effective, and reasonable. After all, you won’t need to reconfigure a lot of stuff to incorporate thousands of custom features for a casual mobile game.

-

Your ambition is to develop a decent game within a reasonable timeframe. Since Unity is a user-friendly platform, let alone that it has a low entry threshold for your game development team, you will likely get all the work done more quickly compared to other, more heavyweight game engines without losing any quality.

-

You want to save resources and still get an awesome game. Game development with Unity, of course, isn’t a cakewalk at all, but it’s comparatively developer-friendly, which enables your team to complete their tasks more effectively and not for millions of dollars. Besides, you can hire middle Unity game developers and artists for this purpose, thanks to an intuitive user interface and a beginner-friendly programming language that powers this platform. Undoubtedly, C# can’t be called a simple technology, but it’s relatively more straightforward than C++, which is the main programming language in Unreal Engine.

When it comes to AA+ game development, it’s time for Unreal Engine. Why? There are quite a few reasons for that.

-

It supports premium-quality graphics. If you plan to make a top-notch game for your audience, you’ll definitely need the functionality under the hood of Unreal. It allows you to build big open worlds with hundreds of unique NPCs, points of interest, impressive VFX, both horizontal and vertical levels, etc. There’s no denying that the end graphics quality you get is the best beyond compare in the present-day game development industry, especially if you’d like to use its fifth generation.

-

It enables you to configure the internal system as long as you need it. In case your upcoming game needs to be enormously feature-rich, and you want a custom-tailored game development approach, Unreal Engine is an open-source solution, implying your developers can even write their own plugins to broaden its functionality, as per your request.

-

Technology-rich functionality. With its latest update, Unreal Engine has been offering state-of-the-art technologies, like Lumen, Nanite, MetaHuman, Pixel Streaming, and many more. If your ambition is to develop a high-end large-scale game, these technical solutions will come in handy and simplify your team’s workflow significantly, which will affect the cost as well as the timeframe needed to finalize the project.

As you can see, both game engines are perfectly fine for their purposes. That’s why you should get in touch with our game development company and discuss your project in great detail for us to evaluate it, calculating the cost, time, as well as other resources. All the preliminary work and preparations are essential when it comes to game development since they allow for process optimization, which is our central priority — to help you reach your goal optimally.